Mortgage Research

In a market waiting for change, the smartest move is planning ahead!

As we navigate the spring market, one thing remains clear: now is the time to put a proactive mortgage strategy in place. Whether you’re approaching renewal, considering a new home purchase, or thinking about leveraging your home’s equity, being prepared ensures you're ready to act—no matter what the future holds.

WHY TIMING MATTERS

Interest rates are on pause—for now. After a series of rate cuts beginning last June, the Bank of Canada held its key interest rate at 2.75% earlier this month. While some economists anticipate the possibility of further decreases later this year, much depends on how the broader economy evolves. In the meantime, today’s stable rates present an opportunity to explore your options—whether that means securing a better deal on a new mortgage or refinancing your current mortgage.

At the same time, housing affordability and access to homeownership are major themes in the platforms of both the Liberal and Conservative parties. No matter who forms the next government, there will likely be policy changes that affect the housing market. However, those changes won’t be immediate. Legislation and programs take time to design, pass, and implement. That’s why preparing now makes sense—you’ll be positioned to take advantage of today’s conditions and ready to adapt when changes do come.

A quieter market could be an opportunity.

The spring market has been slower than usual, with many buyers and sellers waiting for clearer signals before making a move. This quieter environment can actually work to your benefit. With fewer buyers competing for homes, you may find better opportunities to negotiate or even secure a home at a better price.

WHAT YOU CAN DO RIGHT NOW

If your mortgage is renewing within the next 12 months be proactive! You don't have to wait for your lender's renewal letter and you don't have to accept their offer without considering your options first. It’s always a good idea to shop around – and renewal is a great time to re-evaluate your situation so you can make any changes if necessary.By starting the renewal process early, not only do you give yourself time to secure a better deal, potentially saving thousands of dollars in the long term, you can lock in a favourable rate and avoid unpleasant surprises.

If you're considering a home purchase get pre-approved now to understand your buying power. Pre-approval helps you act quickly when the right property or rate becomes available. It also helps you focus your home search within your budget, saving time and stress. If the market shifts, having pre-approval in place makes it easier to act decisively.

If you’re thinking about accessing your home equity this is an excellent time, with home values in many areas remaining strong. Whether you want to consolidate high-interest debt, fund home improvements, or build financial flexibility for the future, refinancing now can give you more options as market conditions remain steady. Don’t wait for potential changes in rates or policy—take advantage of the current window of opportunity.

Even if you’re not planning any immediate moves, it’s always helpful to check in with your mortgage professional. With changes potentially on the horizon, staying informed will ensure that you're prepared for whatever comes next.Whether you’re renewing your mortgage, buying a new home, or tapping into your equity, I’m here to help you build a strategy that aligns with both your short- and long-term goals.

Connect with The House Team today and let’s get you on track for what’s to come. Call 613-962-1388 or request a free 15-minute appointment with The House Team HERE - we're here to help!

Spring Market Outlook: What Buyers and Homeowners Need to Know

Spring is here, and with it comes one of the busiest times in the Canadian housing market. As the snow melts and For Sale signs start popping up, many buyers and sellers are wondering: what’s the market like this year? Whether you’re looking to purchase a new home, refinance, or simply stay informed, here’s what you need to know about the spring real estate landscape

MARKET TRENDS: A BALANCING ACT

The Canadian housing market continues to find its footing after several years of interest rate fluctuations, inflation concerns, and economic uncertainty. While some regions are experiencing increased buyer activity, others are seeing more balanced conditions as sellers adjust their expectations.

Interest rates remain a key factor. The Bank of Canada has kept rates steady after a series of increases, and while there is speculation about potential rate cuts later in the year, nothing is guaranteed. This means that mortgage affordability remains a primary concern for many buyers. If you’re in the market for a home, locking in a competitive rate now could be a smart move, rather than waiting for conditions that may or may not improve.

WHAT BUYERS SHOULD CONSIDER

Spring tends to bring more listings, which is great news for buyers who were frustrated by limited inventory in previous months. However, more listings can also mean more competition.

If you’re thinking of buying, be prepared:

- Get Pre-Approved: Knowing exactly how much you can afford before you start house hunting gives you a competitive edge.

- Act Fast, But Stay Smart: Homes in desirable areas may still sell quickly, so be ready to make an offer—but don’t let yourself get pressured into a rushed decision. At the same time, don’t sit on the sidelines waiting for rates to drop, assuming you’ll get a better deal. When rates fall, competition heats up, often driving home prices higher. A slightly higher mortgage rate on a well-priced home can be a better financial move than securing a lower rate on an inflated price later.

- Think Beyond Rate: Mortgage rates are important, but so are terms, flexibility, and long-term affordability. A well-structured mortgage can save you money over time.

FOR HOMEOWNERS: IS IT TIME TO REFINANCE?

If you’re a homeowner with a mortgage coming up for renewal, now is the time to review your options. With rates having risen over the past two years, you may be facing higher payments than before. However, lenders are competitive, and there may be opportunities to restructure your mortgage to better fit your financial goals.

A mortgage review can help you determine whether refinancing, switching lenders, or adjusting your term length makes sense. Even if you’re not renewing yet, it’s a good idea to plan ahead and explore options before you’re locked into a higher rate.

SELLERS: SETTING REALISTIC EXPECTATIONS

If you’re considering selling this spring, the key is to price your home correctly. Overpriced homes tend to sit on the market longer, while competitively priced properties attract serious buyers. Work with a knowledgeable real estate agent to assess recent comparable sales and set a fair asking price.

Presentation matters, too. With more homes hitting the market, staging and curb appeal can make a big difference in attracting buyers. Small upgrades, decluttering, and professional photos can help showcase your home in the best light.

PLANNING AHEAD IS KEY

Spring is an exciting time in real estate, but it’s also a season that requires careful planning. Whether you’re buying, selling, or refinancing, having a strategy in place will help you make informed decisions and get the best outcome.

As your mortgage advisor, we're here to help you navigate these choices. If you have questions about mortgage options, pre-approvals, or refinancing strategies, let’s chat. The right advice now can set you up for financial success in the months and years ahead, and save you thousands of dollars. Call 613-962-1388 or request a free 15-minute appointment with The House Team HERE to plan your next steps.

Navigating Uncertainty: How trade tensions could impact mortgages, housing, and rates

With trade wars and tariffs dominating the headlines recently, many are wondering what effect this could have on the housing market. Lower interest rates offer some relief, but we're now facing the potential of tariffs driving up costs. So, what does it mean for mortgage rates, home prices, and affordability? Here's an overview of how tariffs could impact the housing market.

In late January, the U.S. announced that it would impose tariffs on certain Canadian goods, which prompted retaliatory measures from our government. Then, in an eleventh-hour deal, both countries agreed on a 30-day suspension. More recently, the U.S. announced that it would impose a 25% tariff on Canadian steel and aluminum imports. With the threat of more tariffs still looming, the situation remains unclear.

If tariffs do go into effect, this could lead to higher costs in construction, home renovations, and mortgage rates. Here’s what’s already unfolding:

- The Canadian dollar has seen drops, making imported goods, including construction materials, more expensive.

- Stock market fluctuations indicate general unease about economic stability, affecting investor confidence and borrowing conditions.

HOW COULD TARIFFS IMPACT THE HOUSING MARKET?

1. Higher Construction and Renovation Costs

Many materials used in Canadian homebuilding are imported from the U.S. If tariffs increase costs, this could lead to:

- Fewer new homes being built, further tightening the supply

- Rising home prices due to higher material costs

- More expensive home renovations for current homeowners

2. Mortgage Affordability and Interest Rate Uncertainty

On January 29th, 2025, the Bank of Canada announced its sixth consecutive rate cut to support the economy. Further rate cuts in 2025 were widely expected but some analysts suggest that tariffs could lead to inflation, which might pressure the Bank of Canada to halt or reverse rate cuts. Others argue that economic slowdowns resulting from trade disruptions could lead to further rate reductions.

3. Market Volatility and Buyer Behaviour

Uncertainty surrounding trade policies could lead to mixed reactions in the housing market:

- Some buyers may rush to secure lower mortgage rates before potential increases.

- Others may pause their homebuying plans, waiting for greater economic clarity.

- Regional markets may be affected differently, with some areas maintaining demand while others slow due to affordability concerns.

WHAT DOES THIS MEAN FOR YOU?

- If you have a variable-rate mortgage: The recent rate cut means lower payments for now. However, if inflation rises due to trade disruptions, further rate cuts may not materialize, and rates may even increase.

- If you have a fixed-rate mortgage: Refinancing might still be a good option while bond yields remain low, but market uncertainty could impact lender rates.

- If you are planning to buy a home: Rising construction costs could mean fewer new homes and higher prices. Acting sooner rather than later could help secure a better mortgage rate and affordability.

HOW TO STAY AHEAD

The housing market is evolving rapidly and having the right mortgage strategy is more important than ever. Whether you're looking to buy, refinance, or explore your options, our team of mortgage experts can help you navigate these changes with confidence.

Let’s discuss your mortgage strategy before conditions shift! Call 613-962-1388 or request a free 15-minute appointment with The House Team HERE to plan your next steps.

Do You Need A Personalized Paydown Plan For Your Holiday Bills?

Most Canadians suffer with their highest personal debt load in January, when the “holiday hit” arrives and your credit card statements let you know just how much the festive season cost you. It’s especially hard if you already had outstanding debt before the holidays. That’s why now is the perfect time to talk about your Personalized Paydown Plan.

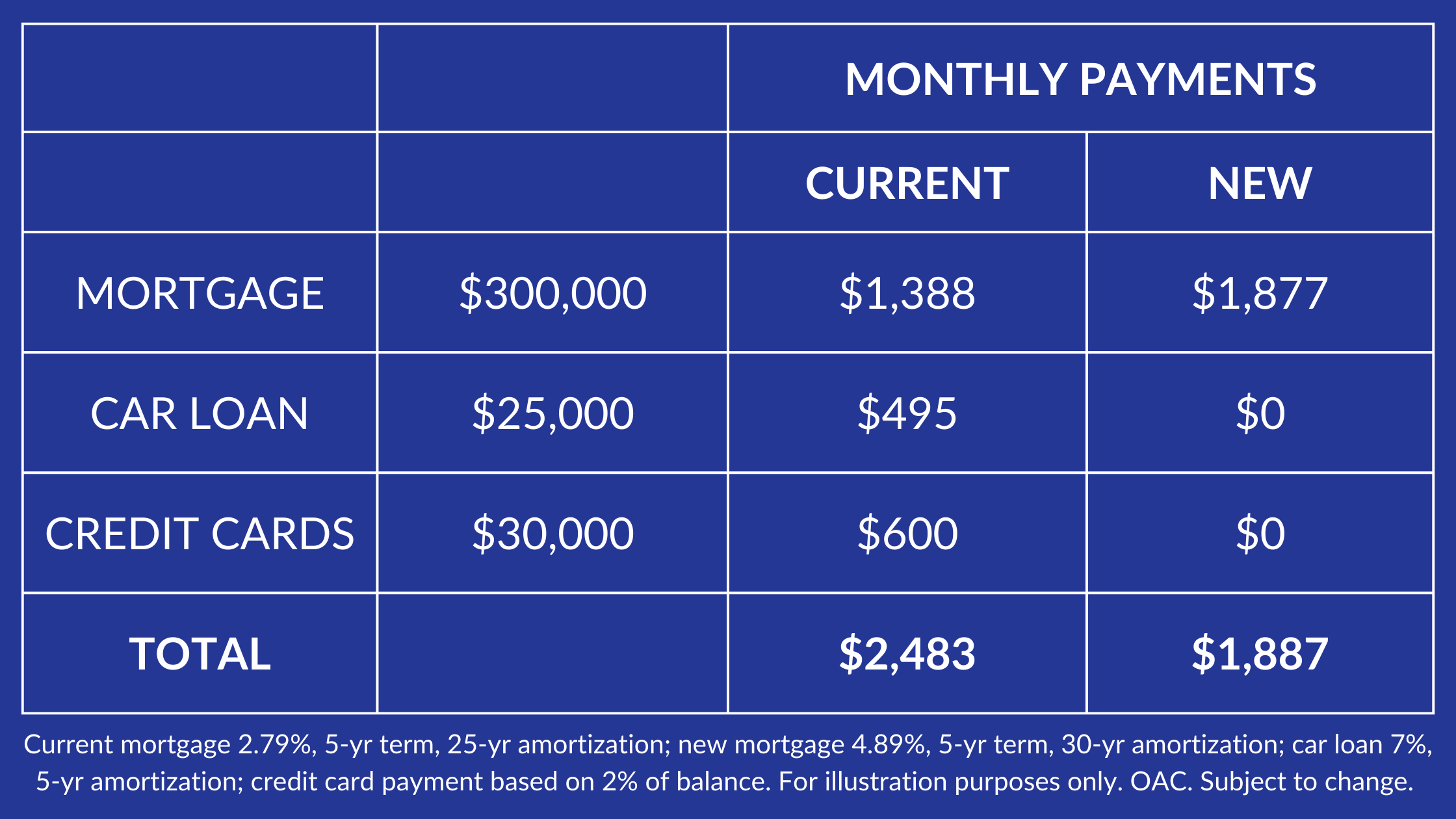

If you have at least 20% equity in your home, I can show you how to use it to roll your high-interest debt into a new mortgage for overall savings. Here’s an example—in this case, mortgage, car loan, and credit cards total $355,000. We roll that debt into a new $358,000 mortgage, including a fee to break the existing mortgage, and take a look at the result:

That’s a savings of $596 each month. Now let's decide how you can use that $596. If you use your prepayment privileges and apply it to your mortgage, you could reduce your amortization from 30 years to 18 years. Or, invest it in an RRSP, RESP, or TFSA to reap tax benefits and grow your wealth.

You could also consider putting a portion into a dedicated “December fund” so the next holiday season doesn’t bring financial stress. Instead, you can enjoy guilt-free giving, knowing the bills are covered.

While refinancing is not an option for everyone and every situation, I have access to other financing options that can help. If you think you could benefit from this kind of financial restructuring, get in touch and we can review your situation carefully to determine the best path for you.

Two Tax-time Advantages for First-time Buyers

The 90-day boost – If you’re buying your first home now and your closing date is at least 90 days away, let’s talk. The Federal Home Buyers’ Program (HBP) and a tax refund can boost the funds you have available for your purchase. First, make as big an RRSP contribution as you can – up to your contribution limit or $60,000 per person. You can even use your downpayment savings for this. Big RRSP contribution means a great 2024 refund. Then, after 90 days, you can go back into your RRSP and redeem your contribution under the HBP program. So you’ve got your original downpayment funds back PLUS a nice tax refund. You’ll need to pay the withdrawn funds back on a repayment plan, but this strategy can make a substantial difference in the affordability of home ownership!

$1,500 for first-time buyers – Don’t leave money on the table if you bought your first home last year! You may be able to take advantage of the Home Buyers Tax Credit (HBTC) when you file your tax return. The $10,000 non-refundable HBTC provides up to $1,500 in federal tax relief. You qualify if neither you nor your spouse (or common-law partner) have owned and lived in another home for the past five years. For more information, visit the Government of Canada website.

The House Team Is Here to Assist

For personalized advice, get in touch with our team here at The House Team. Together, we can make the most of this opportunity and ensure you’re set up for success in the coming year. Call our team at (613) 962-1388 or request a free appointment HERE. We are here to make the process as smooth and stress-free as possible.

Bank of Canada’s Rate Cut: Your Opportunity for Lower Mortgage Payments

During the busy holiday season, there is some welcome news that could bring a little extra cheer at a time when many are looking to make the most of their budgets.

Bank of Canada Announces Interest Rate Reduction

On the final rate announcement for 2024, the Bank of Canada once again reduced interest rates by 0.5% to stimulate economic growth and maintain its inflation targets. This move aims to provide some relief to households, encourage spending, and support businesses across the country. While the rate cut has widespread implications for the economy, it also directly impacts various financial products, most notably mortgages.

What This Means for Your Mortgage

If you have a variable-rate mortgage, you’re likely to see immediate benefits. The interest rate on your mortgage may decrease, which could lower your monthly payments. This is certainly a welcome gift for homeowners, as the lower payments may provide some breathing room in your budget, especially with the higher costs of living many have experienced in recent months. For those of you looking for some financial flexibility during the holidays, this change could be a timely and appreciated break.

If you have a fixed-rate mortgage, the situation is slightly different. Since your interest rate remains locked in for the term of your mortgage, this rate cut won’t directly affect your current payments. However, there’s a silver lining: When your mortgage term comes up for renewal, you may be able to take advantage of the lower interest rates available at that time. This could provide an opportunity to secure a more favourable rate, reducing your future monthly payments or allowing you to pay off your mortgage faster.

Opportunities to Consider

With this interest rate reduction, now could be the perfect time to assess your mortgage situation and explore ways to make the most of these changing conditions. Whether you’re considering refinancing your mortgage to take advantage of lower rates or simply reviewing your current terms to ensure they’re still the best fit for your financial goals, this is a moment to evaluate your options.

Refinancing could help you lock in a lower rate and result in long-term savings. Additionally, refinancing offers the possibility of adjusting your mortgage to better suit your current circumstances, whether you’re looking to consolidate debt or shorten your mortgage term. Given the rate cut, you might also consider the benefits of consolidating other high-interest debts into your mortgage, taking advantage of more favourable terms.

Warm Holiday Wishes

As the year draws to a close and the holidays approach, we want to extend our heartfelt wishes to you and your loved ones. May this festive season bring joy, peace, and prosperity to your home. Whether you’re celebrating with family and friends or enjoying some quiet time to yourself, we hope you have the opportunity to relax, recharge, and reflect on the positive moments of the year.

The House Team Is Here to Assist

For personalized advice, get in touch with our team here at The House Team. Together, we can make the most of this opportunity and ensure you’re set up for success in the coming year. Call our team at (613) 962-1388 or request a free appointment HERE. We are here to make the process as smooth and stress-free as possible.

Our team wishes you a wonderful holiday season and a bright start to the New Year!

Six Reasons To Work With An Expert On Your Mortgage Renewal

Given the large financial commitment of a mortgage, it’s surprising that so many homeowners go on auto-pilot when it’s time to renew. Of course, your lender wants your repeat business and their renewal letter (typically sent between three and six months before your mortgage matures) will make it very easy and convenient for you to oblige – just sign the letter and your mortgage renewal is done.

Some borrowers may not even realize they don’t have to accept their lender’s offer. They can and should explore other options available in the marketplace, especially now since the stress test is no longer a factor if you want to switch lenders at renewal.

So, when you get your lender's renewal letter, ask yourself one simple question: “Can I do better?” The answer in most cases is a resounding “YES”.

Six Reasons To Work With An Expert On Your Mortgage Renewal

Here's why getting a mortgage expert working for you as early as nine months before renewal is a great way to ensure you get the best deal:

- Recently announced changes have eliminated the stress test for borrowers who want to switch lenders at renewal, which means you have a choice! Since we have access to over 50 lenders, and thousands of product options, our team can shop around to ensure you are being offered the best deal possible.

- A good credit score is important when you're looking to switch lenders – and your current lender may also consider your score at renewal. You have more control over your credit score than you think and may want to discuss credit improvement strategies. Our team can help!

- If you have enough equity in your home, you may be able to move high-interest debt to your lower-rate mortgage to improve cash flow and save on interest. Renewal is the perfect time to do this. Our mortgage experts can run the numbers to see if this strategy makes sense for you.

- Taking on new debt or leaving your current employment before renewal can affect your ability to move your mortgage to another lender. We can discuss the potential impact of changes on your personal situation.

- If your mortgage is uninsured, our mortgage brokers can help determine if you can switch to a lower-rate insurable mortgage that offers long-term savings.

- If you need to free up cash flow for specific needs or life situations, a 30-year amortization might be an option for you to consider (20% or more in equity required).

Remember, our team works for you! With access to dozens of lenders and hundreds of mortgage options, our goal is to help you make informed decisions so you always get the best package of rates and features that best fits your needs.

If you have any questions or need personalized advice on how these changes impact you, The House Team is here to help. Call our team at (613) 962-1388 or request a free appointment HERE. We are here to make the process as smooth and stress-free as possible.

Mortgage Reforms Announced by the Government of Canada

The Government of Canada has introduced major mortgage reforms to make homeownership more accessible and affordable for Canadians. In this blog, we're talking about what is changing and how this impacts our community.

Changes include:

- Borrowers switching lenders at renewal will not need to complete the Stress Test

- Canada’s banking regulator, OSFI, is poised to ease mortgage rules for homeowners looking to switch lenders during mortgage renewal. Effective November 21, borrowers renewing with a different lender will no longer need to complete the mortgage stress test, simplifying the process for those with uninsured mortgages. In the past, even a straightforward renewal switch required borrowers to demonstrate their ability to manage payments at a rate 2% higher than the new mortgage contract rate. This posed significant challenges as rates climbed to 6%, bringing the stress test rate to 8%. While insured mortgages were already exempt from this requirement, uninsured borrowers will now receive similar treatment.

- Higher Insured-Mortgage Cap

- Starting December 15, 2024, the insured mortgage cap will increase from $1 million to $1.5 million—the first adjustment since 2012! This update better aligns with today’s housing market, allowing more Canadians to qualify for a mortgage with less than a 20% down payment.

- Extended 30-Year Amortization

- Also coming into effect December 15, 2024, first-time homebuyers and new-build purchasers will be eligible for 30-year mortgage amortizations (previously capped at 25 years) on insured mortgages. The longer amortization period will help make home ownership more affordable by lowering monthly mortgage payments. The change should also encourage new home construction to help ease the housing shortage.

These reforms build on earlier initiatives from 2024, including:

- RRSP Home Buyer’s Plan

- The limit was raised from $35,000 to $60,000, offering Canadians more flexibility when using their savings for a home purchase.

- Permanent Amortization Relief

- Homeowners facing rising mortgage payments now have long-term support through this measure.

As more details are announced we will keep you informed, but these updates are designed to create new pathways to homeownership. Whether you're considering a move, or nearing mortgage renewal, now’s the perfect time to explore your options!

If you have any questions or need personalized advice on how these changes impact you, The House Team is here to help. Call our team at (613) 962-1388 or request a free appointment HERE. We are here to make the process as smooth and stress-free as possible.

Be Prepared! Expert Tips for Mortgage Renewal Success

Recent data from Mortgage Professionals Canada shows that 23% of all Canadian mortgage holders will renew their mortgage within the next year, and a staggering 50% will renew within two years.

So chances are, you are looking at a mortgage renewal within the next two years and if not, unless you are in the enviable position of being able to pay off your mortgage at the end of your current term, a mortgage renewal will be on the horizon for you.

When it comes to renewing your mortgage, whether you’re looking to lower your monthly payments, tap into home equity, or take advantage of the latest mortgage trends, preparing for your renewal can unlock new opportunities.

Here are a few tips to put yourself in the most advantageous position possible at renewal time:

1. Start early.

Begin by reaching out to a mortgage broker four to six months before your renewal date. We’ll review your current mortgage and start exploring options. It’s smart to get a 120-day rate hold so you’re protected against any rate increases while we shop around or, perhaps we’ll explore a more flexible solution that fits your evolving financial goals.

2. Review your financial goals.

Is your financial situation the same as when we last negotiated your mortgage? Whether you're planning to pay off your mortgage faster or want to access home equity for renovations or investments, this is the time to re-evaluate your priorities and make any necessary adjustments to your mortgage.

3. Consider variable rates.

With the Bank of Canada’s recent rate cuts, and more expected, variable rate mortgages are regaining some of their former popularity. Many homeowners are turning to this option for potential cost savings. If you’ve been locked into a fixed-rate mortgage, it might be worth discussing a switch to a variable rate at renewal with your mortgage broker.

4. Leverage your home equity.

If you've built up equity in your home, you can use this to consolidate debt, invest, or cover significant expenses like home renovations. Together, we can explore options that allow you to access equity while keeping your payments manageable.

Note: This option can also be explored outside of mortgage renewal time. If you want to discuss how you can leverage your home equity at any point during your mortgage term, get in touch with our team for a review of your situation.

5. Shop around for the best rate.

Don’t assume your current lender offers the best deal. Shopping around can help you secure a better interest rate or more favourable terms. Reach out and we can do the heavy lifting for you, comparing multiple lenders and options to find what suits you best.

6. Get pre-approved.

If you're considering switching lenders or mortgage products, getting pre-approved ensures you're ready when it’s time to renew. Pre-approval locks in a rate, so you’re protected if rates rise.

7. Plan for the future.

Your mortgage renewal is a great time to reassess your financial plans. Will you need a mortgage that's flexible with prepayment options, or are you focused on paying it off quickly? Plan with both short-term needs and long-term goals in mind.

Taking a proactive approach to your mortgage renewal could save you thousands of dollars and set you up for long-term financial success. The House Team is here to help you navigate the renewal process and find the best solution for your needs.

If you have any questions or need personalized advice on your mortgage needs, The House Team is here to help. Call our team at (613) 962-1388 or request a free appointment HERE. We are here to make the process as smooth and stress-free as possible.

How The Bond Yield Market Impacts Mortgage Rates

Learn how external financial factors can influence your mortgage rates

In the ever-evolving landscape of mortgage financing, it’s crucial to understand how external financial factors can influence your mortgage rates. One significant factor is the bond yield market, both in Canada and the US. Here’s a breakdown of how bond yields impact mortgage rates and why staying informed matters for your financial decisions.

What Are Bond Yields?

Bond yields are essentially the return on investment for bondholders. When investors buy bonds, they are lending money to the government or corporations in exchange for periodic interest payments and the return of the principal amount upon maturity. The yield represents the annual return on these bonds, expressed as a percentage of the bond’s current market price.

How Bond Yields Affect Mortgage Rates

- The correlation between bond yields and mortgage rates: Mortgage rates are closely linked to government bond yields, particularly the 10-year bond yields in Canada and the US. This is because mortgage lenders often use the yields on these bonds as a benchmark to set their interest rates. When bond yields rise, the cost of borrowing for lenders increases, which in turn raises mortgage rates. Conversely, when bond yields fall, borrowing costs decrease, leading to lower mortgage rates.

- Economic indicators: Bond yields are influenced by various economic indicators such as inflation rates, economic growth, and central bank policies. For example, if inflation expectations rise, bond yields may increase as investors demand higher returns to compensate for the eroding purchasing power. This rise in yields usually translates into higher mortgage rates. Similarly, if the central bank signals that it will raise interest rates to combat inflation, bond yields may increase, leading to higher mortgage rates.

- Market sentiment and risk: Bond yields can also be affected by investor sentiment and risk appetite. During times of economic uncertainty or financial market turbulence, investors may flock to safer assets like government bonds, driving up bond prices and pushing down yields. In such scenarios, mortgage rates may decrease as the lower bond yields make borrowing cheaper for lenders. Conversely, in a booming economy, investors might seek higher returns from riskier assets, pushing bond yields up and causing mortgage rates to rise.

The Canadian and US Bond Yield Dynamic

While Canadian and US bond yields often move in tandem due to the interconnected nature of the global economy, differences in economic conditions and central bank policies can lead to variations between the two countries. For instance, if the US Federal Reserve raises interest rates more aggressively than the Bank of Canada, US bond yields may rise relative to Canadian yields, potentially leading to a wider spread between US and Canadian mortgage rates.

What does it mean for you?

Understanding these dynamics can help you make informed decisions about your mortgage. If you’re considering a new mortgage or refinancing, keeping an eye on bond yields and related economic news can provide insight into future rate trends. It’s also advisable to work closely with your mortgage professional to navigate these fluctuations and secure the best possible rate for your situation.

Bond yields play a pivotal role in shaping mortgage rates. By staying informed about bond market trends and their implications, you can better manage your mortgage strategy and make decisions that align with your financial goals. If you have any questions or need personalized advice on your mortgage needs, The House Team is here to help. Call our team at (613) 962-1388 or request a free appointment at https://www.thehouseteam.ca/request-an-appointment.

Myths Debunked: Get the Real Facts!

Understanding the real facts about mortgages is crucial for making informed decisions that can save you time, money, and stress.

There are many myths out there about mortgages that can lead to confusion or missed opportunities. Today, we’ll debunk some of the most common mortgage myths.

Myth #1: You Need a 20% Down Payment

While it's true that a 20% down payment can help you avoid mortgage loan insurance and reduce your monthly payments, it's not a hard and fast rule. There are several loan options available that require much lower down payments as long as you have insurance.

For example, Canada has three mortgage insurance companies CMHC, Sagen, and Canada Guaranty which allow you to put down as little as 5% if the house is under one million dollars. If the home you are looking to purchase is over one million dollars, the minimum down is 20%. Don't let the 20% myth hold you back from exploring your options!

Myth #2: Prequalification and Preapproval Are the Same

It’s easy to confuse prequalification with preapproval, but they serve different purposes. Prequalification is an initial estimate of how much you might be able to borrow, based on self-reported information. It's a useful starting point but not a guarantee. Preapproval, on the other hand, involves a thorough credit and financial check, providing a more accurate and reliable estimate of your borrowing power. This can make a significant difference when you're ready to make an offer on a home.

Myth #3: You Can’t Get a Mortgage with Student Loans

Many people believe that having student loans automatically disqualifies them from getting a mortgage. However, if you meet the required ratios and have a good credit history, student loans do not have to be a barrier to homeownership. Lenders consider several factors, including your debt-to-income ratio, credit score, and employment history. To improve your chances, focus on reducing existing debt and avoiding new loans. Maintaining a good credit score by making timely payments on your student loans will enhance your mortgage application. With diligence and the right strategy, balancing student loan payments and securing a mortgage is within reach.

Myth #4: The Lowest Rate Is Always the Best Option

While securing the lowest mortgage interest rate may seem like the best option, it's essential to consider the bigger picture. A lower rate can be enticing, but it often comes with trade-offs such as higher fees, or less favourable loan terms. It's crucial to evaluate the overall cost of the mortgage, including closing costs, fees, and the loan's duration. Sometimes, a slightly higher interest rate might come with better terms, such as lower closing costs or more favourable repayment options, which could be more beneficial in the long run.

Myth #5: You Should Always Choose a 30-Year Fixed Mortgage

The 30-year fixed mortgage is popular for its stability and predictability, but it’s not the only option. Depending on your financial situation and goals, a 15-year fixed mortgage or an adjustable-rate mortgage (ARM) might be more beneficial. For example, a 15-year mortgage can save you money on interest and help you build equity faster, while an ARM might be advantageous if you plan to move or refinance within a few years.

Understanding the realities behind these common mortgage myths can empower you to make better decisions and take advantage of the opportunities available to you. If you have any questions or need personalized advice on your mortgage needs, The House Team is here to help. Call our team at (613) 962-1388 or request a free appointment at https://www.thehouseteam.ca/request-an-appointment.

Home Improvement: Which Projects Boost Your Property Value?

Find out which home improvement projects offer the highest return on investment

For many homeowners, home improvements aren't just about creating a more comfortable living space—they're also key to boosting property value. Here are the home improvement projects that offer the highest return on investment (ROI), and some helpful tips on balancing costs and benefits.

High-ROI Home Improvement Projects

-

Kitchen Renovations: Upgrading your kitchen can have a significant impact on your property's value. New cabinets, countertops, and appliances can refresh the space, making it more appealing to potential buyers. Kitchen renovations offer an average ROI of up to 70-80%. For cost-effective upgrades, consider minor changes such as replacing hardware or painting cabinets, which can still create a substantial visual impact.

-

Bathroom Upgrades: Modernizing bathrooms, including fixtures, lighting, and tiling, can significantly boost value. Such projects can offer an ROI of up to 60-70%. To balance costs, consider reglazing tubs or replacing faucets, which provide an immediate facelift at a fraction of the cost.

-

Energy-Efficient Upgrades: Installing energy-efficient windows, doors, and appliances not only increases the immediate value of your home but also leads to long-term savings through lower energy bills. The ROI of these upgrades can be measured both in terms of immediate value increase and long-term savings.

-

Curb Appeal Enhancements: Enhancing the exterior of your home through landscaping, painting, or installing new doors can significantly improve its curb appeal, offering an immediate visual impact. Such projects can yield an ROI of up to 90-100%.

Balancing Costs and Benefits

- DIY vs. Professional Help: Deciding whether to take on a renovation yourself or hire a professional requires careful consideration of several factors. First, evaluate the complexity of the project. If it involves specialized skills, such as electrical or plumbing work, or significant structural changes, it may be safer and more efficient to hire a professional. Next, assess your own skills, time, and resources. Consider the potential for mistakes that could lead to higher repair costs down the line. You will also want to examine your budget; professional help may increase initial expenses, but can ensure quality work that adds lasting value to your home.

- Budgeting: Start by setting a clear budget that reflects your goals, project scope, and current financial situation. Consider breaking down costs into categories, such as materials, labour, permits, and contingency funds for unforeseen expenses.

For financing, explore options such as home equity loans or lines of credit, which leverage your home's existing equity for funds. Personal loans are another alternative, offering fixed interest rates and repayment terms. Comparing different financing options, understanding their terms, and aligning them with your renovation goals will ensure your project stays on track and within budget.

- Future-Proofing: Choosing renovations that will add value to your home now and for years to come requires a strategic approach. Focus on projects that enhance both functionality and aesthetics. For instance, modernizing kitchens and bathrooms can create immediate appeal while remaining relevant over time. Additionally, consider energy-efficient upgrades, such as improved insulation, windows, and appliances, which not only lower energy bills now but also attract environmentally conscious buyers in the future. Curb appeal enhancements, like landscaping and exterior improvements, offer immediate visual impact and contribute to long-term value.

This strategic combination of current appeal and enduring functionality can yield substantial returns for years to come.

Focusing on high-ROI projects, balancing costs, and making informed decisions are key to successful home improvements. If you have any questions or are considering exploring mortgage options to fund your upgrades, contact The House Team. We are here to help! Call our team at (613) 962-1388 or request a free appointment at https://www.thehouseteam.ca/request-an-appointment.

New Housing Measures In Federal Budget

The Government of Canada unveiled its federal budget on April 16th, 2024

As your trusted mortgage broker, we’re always on the lookout for developments that can impact your homeownership journey. This blog brings hopeful news on the housing front that we're eager to share with you.

Federal Budget & Housing Investments

On April 16th, 2024, the Government of Canada unveiled its federal that lays out the government’s bold strategy for those looking to buy a home or struggling with housing affordability. The budget is allocating billions of dollars toward the construction of new homes and supporting low-cost housing programs.

This commitment to substantial investments in housing comes at a crucial time. Canada's housing affordability crisis has been exacerbated by a rapidly increasing population and economic pressures like high inflation and interest rates — the highest we've seen in 22 years. These factors have made it more challenging for many

Canadians to find affordable homes or keep up with rent and mortgage costs.

What This Means for You

The upcoming investments aim to ease these pressures by increasing the supply of homes and making housing more accessible to everyone. This includes significant support for the construction of new homes and enhancing low-cost housing programs.

This strategy is set to unlock 3.87 million new homes by 2031, which includes a minimum of 2 million net new homes on top of the 1.87 million homes expected to be built anyway by 2031.

This budget also announced the new Tax-Free Home Savings Account, which is a registered savings account that allows Canadians to contribute up to $8,000 per year (up to a lifetime limit of $40,000) for their first down payment.

To learn more about the full extent of these plans, visit The Government of Canada’s 2024 Federal Budget Report.

Looking Ahead

It's important to note that while these investments are a step in the right direction, the impact won't be immediate. Canada needs to build 315,000 new residences annually through 2030 to keep pace with population growth — a challenging but necessary target to ensure a future where everyone can afford a place to call home.

Our Commitment to You

We understand that navigating the housing market, especially in times of change, can be overwhelming. We are here to help you understand what these developments mean for your individual situation and how you can leverage them to your advantage. Whether you're buying your first home, looking to invest, or exploring refinancing options, we are here to provide you with expert advice and solutions tailored to your needs.

Please reach out with any questions or for a personalized consultation. Remember, we’re more than just your mortgage broker; we are YOUR partner in making homeownership dreams come true.

You can call (613) 962-1388 or request a free appointment at https://www.thehouseteam.ca/request-an-appointment.

____________

Canada's banking regulator, The Office of the Superintendent of Financial Institutions (OSFI), is introducing a new portfolio test to manage the risk associated with highly indebted borrowers, especially as mortgage rates are set to potentially decrease which may make it easier for individuals to qualify for larger loans. This test will monitor banks' quarterly loan-to-income ratios, specifically focusing on ensuring that the portion of a bank’s uninsured mortgage loans exceeding 4.5 times a borrower's income remains under a certain threshold. This initiative stems from concerns that loans exceeding 4.5 times borrower income significantly increase the likelihood of default, especially in the context of the recent trend of low interest rates followed by sharp increases since spring 2022.

The portfolio test is not designed to directly impact individual borrowers' ability to secure mortgage loans. Unlike the mortgage stress test, this measure targets banks' uninsured mortgage loan portfolios as a whole rather than imposing additional requirements on homebuyers. This regulatory move is part of a series of anticipated adjustments to mortgage guidelines aimed at preventing the build-up of high-risk loans during low-interest-rate periods.